If you are using the newest QRC ability specific information is collected away from the mobile device to have business objectives. There isn’t any extra fee for making use of Mobile Consider Deposit, however, we recommend that your check with your provider in order to find out if you will find people wireless provider charge. Cellular put lets you complete pictures of the front and back of your endorsed, qualified consider. You can save time which have fewer travel to a Wells Fargo Automatic teller machine or part.

Friend Financial Using Membership – play bingo online

Sure, you can put a personal take a look at with the cellular application in the event the you’ve got a combined account. You may have to has both members recommend the newest take a look at before deposit they. Sure, particular banking companies provides a limit on the amount of monitors your is deposit a day otherwise monthly with the cellular application.

Get on your Money You to definitely Mobile banking software and select the fresh membership we should put the newest check into, following click the Deposit choice beside the digital camera icon. Following, input the brand new deposit count and every other questioned suggestions. The sorts of checks you can deposit may differ depending on and therefore financial institution you employ. For instance, Money One users can be generally deposit U.S. individual, team otherwise government checks with the Funding You to Cellular app. In addition to, could it be a secure way to deposit money in your Investment You to definitely membership?

You’ll know how to recommend a, simple tips to get a great pictures of your own look at with your app and the ways to manage well-known pressures that may arise. play bingo online Banks do not enforce limits to your amount of cash one to you could potentially put in a single transaction. However, after you make an enormous take a look at deposit their bank can be place a hang on the amount of money. At the same time, if you make an enormous dollars deposit you may need to take on running charge. There aren’t any limits for the sum of money you could potentially deposit into the examining otherwise savings account. Apart from a number of formalities, the entire process of depositing a large amount of cash is comparable to that particular of smaller amounts.

- If you need to help you automate your own income places, you may choose to make use of direct deposit.

- If your financial also offers cellular view put therefore refuge’t tried it but really, unlock the new app the next time you get a.

- Get to know their bank’s mobile application functionalities.

- Very banking institutions merely undertake inspections from the regional currency for mobile places.

- You can find deposit constraints, and believe the newest deposit strategy.

- Secret Financial and you can TD Financial, such, charges a great dos% commission to possess quick access, if you are Nations Financial charge around cuatro%.

Check with your financial observe the insurance policy for carrying dumps as well as how easily the mobile view places would be to obvious. Hopefully this short article have aided one to discover mobile look at deposit limits during the significant banks including the you to definitely your bank having. After you’re also armed with this information, you can be assured understanding your own look at tend to put as opposed to matter. Just make sure that you’lso are signed into the best banking software before you start snapping images and you may uploading him or her.

Get the lender’s cellular application

It is as the secure and safe while the deposit a check in the person, if you take the time to maintain your passwords and other digital information safer. Wells Fargo cellular deposit provides a simple, free and you can safer treatment for deposit checks. Because of the number of most other beneficial features regarding the application, you’re also gonna find cellular banking is reasonable not simply for deposits, however for overall membership administration also. Wells Fargo cellular put will provide you with a fast and you may safe means to incorporate finance to your deposit accounts by using the camera for the your own cellular telephone or another mobile device.

GOBankingRates works together with of numerous economic advertisers in order to show their products or services and you can functions to your visitors. This type of names compensate us to advertise items within the advertisements around the our web site. That it compensation could possibly get impact exactly how and you may where points show up on which webpages. We are really not an evaluation-tool and these also provides don’t represent all the available put, money, financing otherwise credit things. Atm hosts are made to take on dumps and you may inspections for just regarding the any amount. If you do have a big take a look at to dollars, a huge majority of the money could be kept before you could are allowed to use them.

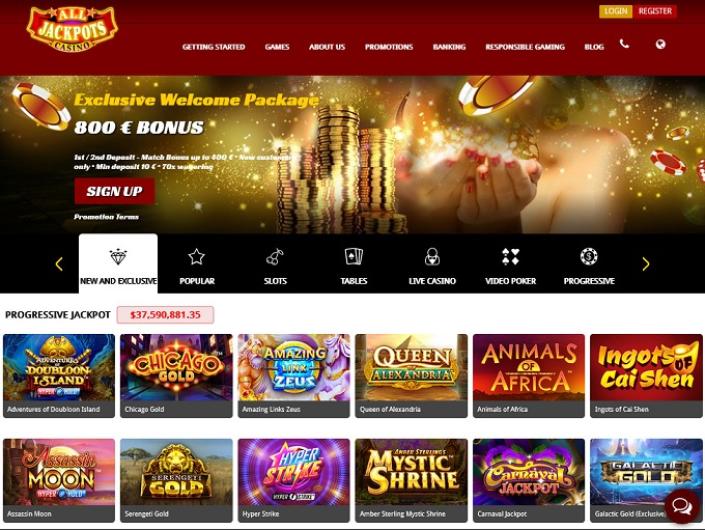

That it casino claims it operates Alive talk within the English vocabulary at least few hours every business go out. Star rating are affiliate of your own Fruit Software Shop score to your See mobile application and that is current everyday. The essential difference between “Depositor” and you may “Submitted from the” only pertains to put account that have a dependable Representative listed. Of these deals, the primary membership holder’s name is demonstrated as the “Depositor” and also the Leading Associate is actually demonstrated as the “Filed because of the.” Comprehend your account arrangement very carefully and look along with your standard bank. Consult your lender otherwise your account contract to see and this cheques you can deposit using digital put.

Of several date people want to make mobile currency places while on the brand new go, often playing with a public Wi-Fi relationship, which’s equally important of your choice a broker with a high-top protection. It’s not advised to deposit another person’s check up on your own account since when you deposit a, you’re endorsing it and you will verifying that you have the right for the cash. Depositing another person’s check out your account will be felt deceptive hobby.